One Sentence Summary

One Paragraph Summary

What ACTIONS/HABITS Will I develop after reading this book?

Book Details

Introduction

Summary

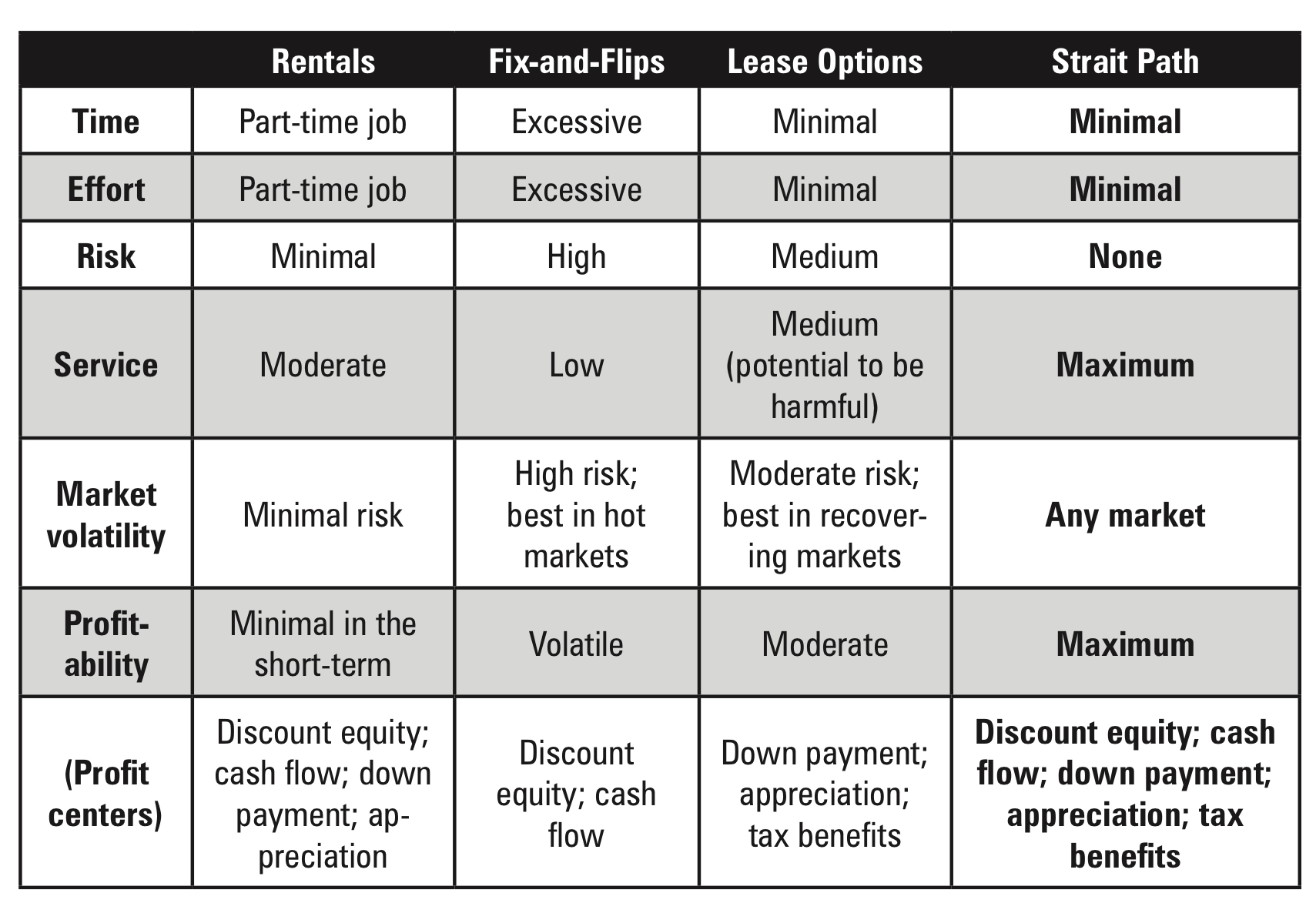

The six core elements for real estate investing are:

- time

- effort

- risk

- service

- market conditions

- profit

Profit should come from the purchasing of a home at a discount, rather than appreciation.

Chapter Details

Chapter 1: The Crucial Mental Shift: Overcoming America’s Broken Financial Paradigm

Summary

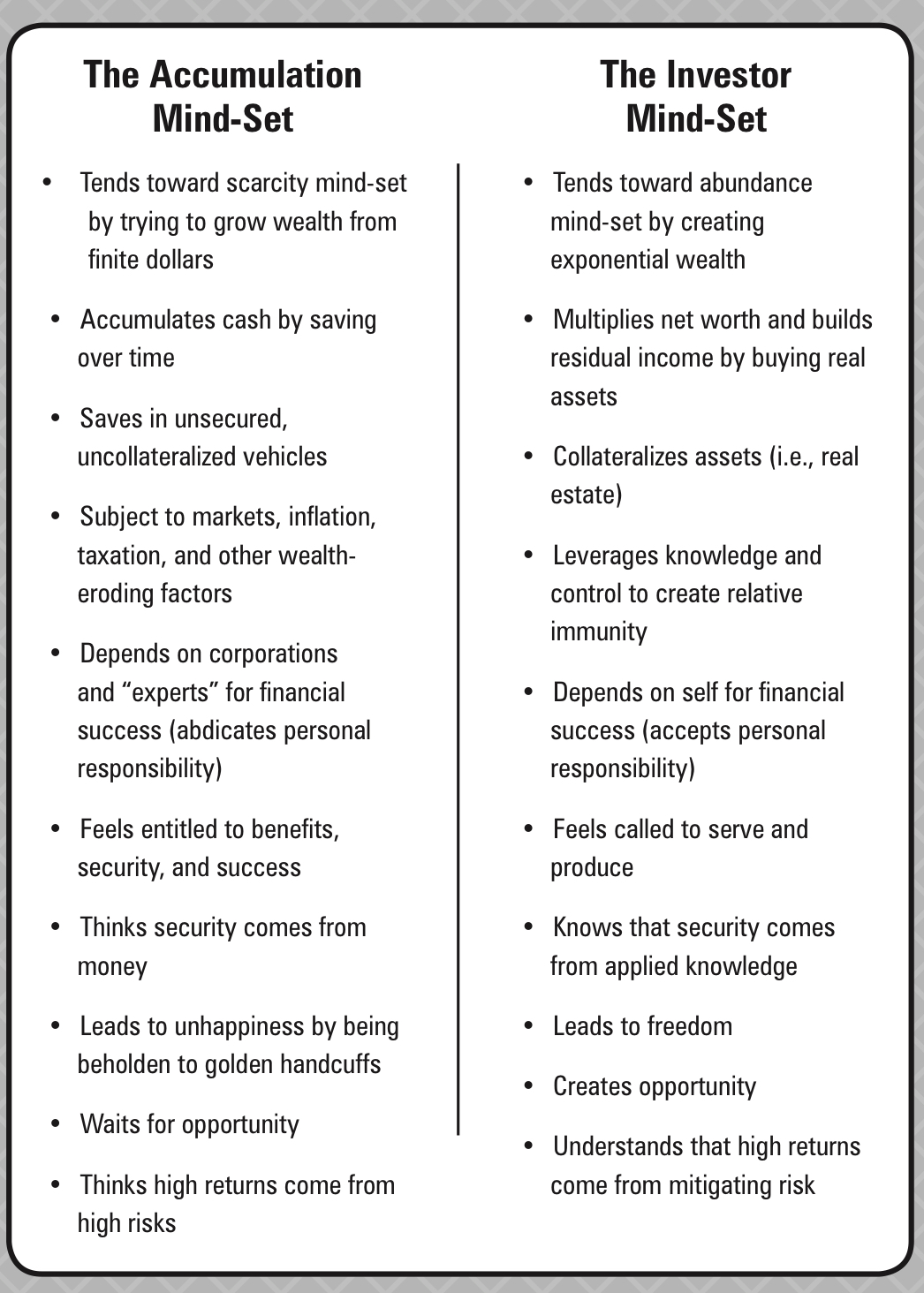

Before pursing the Strait Path, we get to change our mindset from an accumulator mindset to an investor mindset.

Why should we change our mindset?

The accumulator mindset focuses on safety, stability, and avoiding risks. They do this by relying on one source of income and placing long, slow, “safe” bets.

The investor mindset focuses on generating cashflow. Hard cash that increases overall income, rather than fighting to maintain a current lifestyle up until retirement.

Investors are problem solvers who love learning through practical experience.

Because they are so resourceful from the habit of experience, they have a habit of seeing how to make the most out of anything, hence their proclivity to recognize opportunity from anywhere.

The two core beliefs that enable an investor mindset are always choosing the right attitude at the beginning of any endeavor, and by taking action now, regardless if it’s perfect.

The end result of someone with an investor mindset is someone who gets to choose when they want to work, how they want to spend their time, and ultimately, confidence and enthusiasm that comes from acton.

Chapter Details

The goal of investing is to have cash flow–you are free when you have assets that put money into your pocket.

That’s why buying a house, and paying off the mortgage too early, can be an issue–what you gain in peace of mind you sacrifice in investing into other assets.

But peace of mind is an illusion; if you seek safety, you will be mislead.

Kris does believe that everyone should pay off their mortgage, but in the right order of doing so, while preventing premature retirement.

Investing is all about earning cashflow, and having control over that cashflow yourself through self-reliance–because no one will care more about your money than you.

The issue with traditional retirement vehicles, such as IRAs or 401(k)s, is that they may perform well in the long run, BUT they may perform poorly right when you’re looking to cash out for retirement. That’s what happened to elderly people in 2008 when they believed their IRAs would be safe forward.

Moreover, we simply may not even have enough money to pull from our retirement accounts; contributing the maximum to an IRA for 50 years yields about $1million dollars, which is roughly a $50,000/yr payout. That’s poverty living. And when you consider inflation, it’s even worse.

Aside from the issue with paying off the mortgage too early, or putting your money into stocks, we also need to consider our own personal cashflow.

And this is where Kris mentions the difference between accumulators and investors.

Think of accumulators as the FIRE movement; they save diligently, counting on the market to bring us the returns we need, just until we have a large enough “nest egg” that will permit us to live off the interest.

Characteristics of accumulators:

- They avoid risk

- They rely on one or two household income sources

- They wait for opportunity

The investor, on the other hand, is the opposite. Investors create opportunity by choosing the creative power of abundance, rather than waiting for the market to bring enough returns.

Characteristics of investors:

- Self-reliant

- Calculated risk taking

- Choose to see opportunity and abundance, where others see risk and danger

- Patient, but not passive

- Lifelong student

- Knows how to accomplish something that most people cannot do

- Problem solvers; they are resourceful, and as a result, they see how to make the most out of anything, hence their proclivity to recognize opportunity.

Kris mentions that the difference between the accumulator and the investor is that the accumulator uses creative power to create retirement, while the investor use creative power to create assets that produce cashflow.

Accumulators seek retirement; the investors seek cashflow.

Investors operate in environments that are volatile, risky, and negative.

To facilitate the shift from accumulator to investor, Kris recommends two simple techniques:

- Embracing the possibility attitude

- Living the law of now

(1) is simply having control of your thoughts by choosing to see the positives. Positive people tend to attract more of what they want.

I personally struggled with positivity; the best remedy I found was Meditation + CBT. If you add a healthy, consistent routine of healthy eating and exercising, it will make positive thinking so much easier.

You will become wealthy to the degree that you can see abundance of options

Personally, I used to think only dumb people were positive–but then I started seeing the returns from their lives, and I came to realize that the smartest thing I can do is to be positive and act dumb–or more like a lifelong student who has a veracious curiosity.

It is our attitude at the beginning of a test which, more than anything else, determines it’s successful outcome.

(2) is simply taking action. The world rewards action, and places special preference to imperfect action, because the feedback in quick and honest.

Better to make take action and fail, than to wait until it’s perfect timing to act without any mistakes.

Why?

we learn more from bad decisions than from indecision

Just as Alex Hormozi said, “80% of the work is simply showing up, but it’s that start that most people delay.

Blue Bill thinking is believe that good things come to us if we wait–a more accurate and realistic core belief is that we get what we act for–even bad decisions help give us clarity on the next step

Those who are afraid of making decisions are those who inevitably make the worst decisions because they have little practical experience to draw upon.

Living in the law of now requires faith

If you make mistakes, it will be mistakes born out of a willingness and desire to act when being complacent and conformant is easy.

The fundamental reality of the accumulator mindset is that it doesn’t practically, realistically, and fundamentally, actually work in real life, because it based on theoretical purity on how the world should work

Wouldn’t it be nice to stuff money into a retirement account, and never think of it again, and wake up 5 years from now a billionaire?

That’s Blue Bill thinking Neo.

Chapter 2: Overview of the Strait Path System

Summary

The Strait path is a 10-year plan to build sustainable cashflow through rent-to-own 3-bedroom single family homes that are sold for less than the median home price for that area.

Chapter Details

The Strait Path consists of four core phases:

-

plan

- Identify all assets and resources (even those which may be overlooked)

- Create a clear and detailed 10-year plan

- Stay disciplined by sticking with the system and reinvesting profits

-

find

- Only buy single-family with at least 3 bedrooms and at least 15% equity

- Always purchase below the the median home price for any given area

- Otherwise, we dramatically increase the risk of losing equity from market volatility, which makes reselling much harder

- Only buy homes in livable condition (duh)

- This means avoid fix-and-flips

- Ugly, but livable houses often produce the most cash flow

- Speed to buy is important for great deals; be prepared to act immediately if above criteria is met

- Getting prequalified helps, before even looking at properties

- Find deals on the MLS

- No BS, straightforward approach when negotiating

-

purchase

-

serve

I was quite surprised that Kris only buys single family homes, and avoids townhomes, condos, duplexes, etc.

So this chapter also mentioned seller financing, and it’s basically when you avoid the bank to instead make terms with the seller.

According to ChatGPT, here are some of the reasons why sellers may be incentivized to adhere to seller financing:

- Faster Sale

- the seller may be able to attract more potential buyers, including those who may not be able to obtain traditional financing.

- This can result in a faster sale, which may be appealing to a seller who wants to move on quickly

- Higher sale price

- his is because the financing option may make the property more attractive to buyers who are willing to pay a premium for the convenience of seller financing

- Steady income stream

- Especially appealing for sellers who are looking to generate income from their property without having to manage it themselves

- Tax benefits

- One example: the seller may be able to spread out their capital gains tax liability over time, rather than paying it all at once

- Asset protection

- Seller is able to take back the property if the buyer defaults on the payments

You may be thinking: Why would a seller choose the monthly payments of seller-financing, when they can get paid as a lump sum from conventional loans?

While some sellers may prefer a lump sum payment from a conventional loan, there are situations where a steady income stream from seller financing can be beneficial. Here are some possible reasons why a seller may prefer monthly payments over a lump sum payment:

- The seller is an accumulator, and prefers steady, reliable payouts

- Interest Income

- Higher selling price

- Flexibility: flexibility in terms of the down payment, interest rate, and repayment period

- Lower upfront costs: avoid mortgage origination fee or appraisal fee

Kris mentions the Sandwich Financing technique:

- Secure property under favorable seller financing terms

- On my end, finance the property to another buyer with the rent-to-own system

The goal of this particular rent-to-own system is to deliberately do everything in our power to ensure the tenants are able to purchase the home.

Here are the advantages of rent-to-own over standard renting:

- Tenants take better care of the property

- You collect a larger down payment

- You don’t pay property management fees

- You never have to pay for repairs, because tenants are responsible for maintaining the property

- Lowers debt-to-income ratio compared to rentals, thereby allowing you to purchase more properties

These four bullet points are what increase monthly profits by $300 to $800 compared to standard renting.

Chapter 3: The Six Elements of Successful Investing: Various Methods Compared and Contrasted

Summary

What sets the Strait Path apart from most other investing forms is one key word: Sustainability

Compared with other real estate investment strategies, the Strait Path optimizes for sustained profits.

Chapter Details

We are reminded of the six core elements for real estate investing:

- time

- Don’t make real estate a 2nd job that pays $12/hr

- value your time; it’s your most important asset

- effort

- Related to time; will you need to work excessive hours, just for a net return of $12/hr?

- risk

- No amount of money is worth the fear, anxiety, and uncertainty

- service

- Service to others is rent we pay for our room in heaven

- Whatever we seek in the form of rewards, we must first earn in the form of service

- market conditions

- The Strait Path DOES NOT depend on appreciation to be profitable; it’s simply a nice bonus

- profit

- The Strait Path seeks sustainable, consistent, and predictable profits

There are 5 core profit centers that makes the Strait Path excellent for sustainable profits:

- Discount Equity

- This is when we buy a home that’s less than the median home value within the area

- At least 15% equity is desired

- Cash flow

- Higher monthly payments for occupying a home

- Down Payment

- Averages to $5,000 down per house

- Appreciation

- Not something we aim for, but a nice bonus

- Tax Benefits

- Deducting mortgage interest from taxes

We then review some of the other types of real estate investing, their pros and cons, as evaluated using the six core elements for real estate investing are (see beginning of introduction)

Personally, some of the items that stood out to me were:

- Compared to rentals, the Strait Path improve debt-to-income ratio because of the more generous down pavement AND the higher monthly rent.

- Fix and Flips are basically full-time jobs that could end up paying out $12/hr because the final payout is dependent on the market condition and the appraisal approval (hoping to get +$80K on a property might be a big jump for banks to handle)

What sets the Strait Path apart from most other investing forms is one key word: Sustainability